Buying a home in Florida can be an emotional rollercoaster. The excitement of finding your dream home quickly turns to worry about real estate closing costs. We get how stressful it is to understand lawyer fees for closing in Florida.

Real estate closing costs in Florida are a big deal for buyers and sellers. Our guide will clear up these costs, explaining the average legal fees and other expenses in Florida’s real estate market.

Understanding real estate closing costs is key to planning. In Florida, these costs range from 2% to 5% of the loan amount. For example, a $375,000 mortgage might cost around $8,550. These costs are important steps in making your new home yours.

Key Takeaways

- Closing costs in Florida average 2.3% of the total loan amount

- Legal fees are a significant component of real estate closing costs

- Costs can vary based on property value and location

- Buyers and sellers can negotiate closing cost responsibilities

- Professional legal representation is essential in real estate transactions

Understanding Real Estate Closing Costs in Florida

Florida’s real estate world is complex. Closing costs are key for both buyers and sellers. Attorney fees for home closing in Florida are a big part of this.

Closing costs cover many expenses to finalize a real estate deal. We break down the financial details buyers and sellers face during property transfers.

Definition of Closing Costs

In Florida, closing costs are 2% to 5% of the property’s value. These costs include:

- Loan origination fees

- Title insurance

- Recording fees

- Property taxes

- Appraisal expenses

Role of Legal Professionals in Closings

Legal experts are vital for managing closing attorney fees in Florida. They offer key services to protect both sides during the deal.

| Legal Service | Typical Cost Range |

|---|---|

| Document Review | $300 – $600 |

| Title Search | $200 – $400 |

| Closing Representation | $500 – $1,000 |

Why Legal Representation Matters

Real estate deals have many legal details. An experienced lawyer can help avoid problems. They make sure your interests are safe during the closing.

“Proper legal guidance can save you thousands in future disputes or missed details.”

Knowing about closing costs and legal roles helps buyers and sellers in Florida. They can feel more confident and clear about real estate deals.

Typical Lawyer Fees for Closing in Florida

Understanding legal fees for closing a house in Florida is key. Our guide explains the costs homebuyers and sellers face with real estate attorneys.

Residential closing attorney fees in Florida usually fall between $850 to $1,500. These costs vary based on several factors:

- Complexity of the real estate transaction

- Attorney’s professional experience

- Specific legal services required

- Location within Florida

“Understanding the nuanced cost structure helps buyers and sellers budget effectively for their real estate closing expenses.”

We suggest talking to local real estate attorneys for accurate quotes for your deal.

| Service Type | Typical Cost Range |

|---|---|

| Residential Closing | $850 – $1,500 |

| Commercial Transaction | $1,500 – $3,000 |

| Title Search | $120 – $250 |

Legal fees can change a lot depending on the property and deal complexity. Getting professional help ensures a smooth and legal real estate transfer.

Breakdown of Attorney Services During Closing

When you’re buying or selling a home in Florida, knowing what attorneys do is key. This guide explains the important legal help you get during the closing.

Real estate attorneys are vital in keeping your interests safe during property deals. They handle many important parts of the closing process.

Document Review and Preparation

Attorneys carefully check and make sure legal papers are right. They protect your rights. The cost usually includes:

- Drafting purchase agreements

- Reviewing mortgage documents

- Examining deed transfers

- Verifying contract terms and conditions

Title Search Oversight

Another key part is the title search. Attorneys do deep checks to find any issues with who owns the property.

| Title Search Services | Purpose |

|---|---|

| Property ownership verification | Confirm legal ownership status |

| Lien investigation | Detect possible financial problems |

| Boundary dispute resolution | Find and fix property line problems |

Closing Meeting Representation

In the final steps, attorneys are very important. They make sure everything is legal and talk for you.

“An experienced attorney can save you thousands by spotting legal problems early.” – Florida Real Estate Legal Association

Knowing what attorneys do helps buyers and sellers see the value of hiring one in Florida. Their help reduces risks and makes the complex process smoother.

Factors Affecting Legal Fee Structure

Understanding the complexity of real estate closing legal fees in Florida is key. We need to look at the many factors that affect attorney pricing. These elements shape the costs of closing lawyers in Florida.

- Transaction complexity

- Property value

- Attorney’s professional experience

- Regional market variations

- Overhead costs

Lawyer overhead is a big part of fee calculations. Typically, overhead costs make up 35% to 50% of total legal fees. These costs include things like:

- Office rent

- Professional equipment

- Staff salaries

- Continuing legal education

“Professional expertise comes with associated costs that directly impact legal fee structures.”

Regional differences in Florida can greatly affect real estate closing legal fees. Lawyers in big cities like Miami or Orlando might charge more than those in smaller towns.

| Fee Factor | Impact on Closing Lawyer Costs |

|---|---|

| Transaction Complexity | High complexity increases fees |

| Property Value | Higher value properties require more detailed work |

| Attorney Experience | More experienced attorneys command higher rates |

Understanding these factors helps clients negotiate and choose the right legal help for their real estate closing needs.

Standard Closing Attorney Charges in Florida

Understanding attorney fees for home closings in Florida is key. Homebuyers and sellers must know the typical costs to plan their budgets well.

- Flat Fee Structure

- Hourly Rate Structure

Flat Fee Options

Flat fees offer clear costs for clients. In Florida, lawyers charge set rates for various real estate deals:

| Service Type | Typical Cost |

|---|---|

| Purchase Closing Fee | $595.00 |

| Refinance Closing Fee | $450.00 |

| Title Search Fee | $75.00 – $150.00 |

| Deed Preparation | $150.00 per document |

Hourly Rate Considerations

For complex deals, lawyers might charge by the hour. Standard attorney fees in Florida are usually $250.00 per hour. This is good for detailed legal work or lots of document prep.

Additional Service Charges

Be ready for extra fees for special services:

- Mobile Notary Services: $175.00

- Wire Transfer Fee: $20.00

- Limited Power of Attorney Preparation: $75.00

Knowing these fee types helps clients choose the right lawyer for their real estate deals.

Choosing the right lawyer means looking at fees, what’s included, and your deal’s complexity.

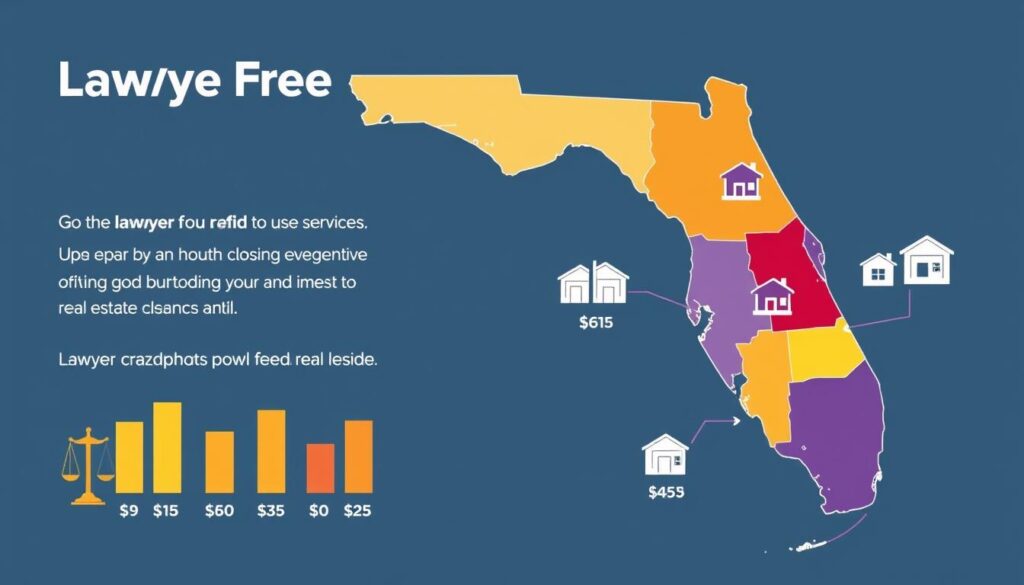

Location-Specific Legal Fees

Legal fees for closing a house in Florida vary a lot by location. These fees change based on the local market, how complex the area is, and its unique features.

Every part of Florida has its own way of pricing legal services. We’ve found out how where you are affects legal fees for closing on a house.

- Central Florida places like Clermont often have lower attorney fees.

- Areas like The Villages, known for retirement communities, might cost a bit more.

- Miami, being an urban area, usually has more complex deals.

What affects costs in different areas includes:

| Region | Average Attorney Fee Range | Complexity Factor |

|---|---|---|

| Wildwood | $450 – $650 | Low |

| Clermont | $500 – $700 | Medium |

| The Villages | $600 – $850 | High |

Homebuyers should ask for several quotes to understand local prices and negotiate better.

Knowing your local market’s legal fee structure can save you hundreds in closing costs.

Title Insurance and Related Legal Costs

Understanding real estate closing costs in Florida means knowing about title insurance and legal fees. These are key to protect buyers and lenders from property disputes.

Title insurance is vital in real estate deals. It keeps property rights safe from legal surprises.

Title Search Fees

In Florida, title search fees are part of closing costs. They vary based on the property’s details:

- Basic title search: $150 – $250

- Comprehensive title examination: $300 – $500

- Complex property investigations: $500 – $750

Insurance Premium Calculations

Title insurance costs in Florida depend on the property’s value and the deal’s specifics.

| Property Value Range | Title Insurance Premium Estimate |

|---|---|

| $100,000 – $250,000 | $1,200 – $2,500 |

| $250,001 – $500,000 | $2,500 – $4,500 |

| $500,001 – $1,000,000 | $4,500 – $7,000 |

Lawyer fees for real estate closings in Florida cover title insurance work. Lawyers ensure title searches and insurance are done right.

Understanding title insurance is key to protecting your real estate investment in Florida.

Pro tip: Always ask for a detailed breakdown of title insurance costs. Know what your policy covers.

Understanding Loan Origination Legal Fees

Understanding loan origination fees in Florida can be tough for homebuyers. These fees are key costs for processing and checking a mortgage application. Our guide explains the main points of standard closing attorney charges in Florida and customary lawyer fees for closing in Florida.

Loan origination fees usually fall between 0.5% and 1% of the loan amount. For a $350,000 home in Florida, this means about $1,750 to $3,500 in legal costs. These fees cover important services like:

- Mortgage application processing

- Document preparation and review

- Credit report analysis

- Underwriting evaluation

It’s important to know that legal fees for loan origination are different from other closing costs. Our research shows that processing and underwriting fees can be between $300 and $900. This depends on the deal’s complexity and the lender’s needs.

“Knowing about loan origination fees helps homebuyers make smart financial choices during their real estate journey.”

When looking at customary lawyer fees for closing in Florida, remember to include these origination fees. Lawyers are key in checking loan documents, making sure all legal rules are followed, and looking out for the buyer’s interests during the deal.

To handle these costs, you could try negotiating with lenders, comparing different loan offers, and understanding the detailed breakdown of standard closing attorney charges in Florida before you finalize your mortgage.

Required Documentation and Associated Costs

Understanding real estate closing documents in Florida can be tough for homebuyers. Knowing the typical legal fees helps buyers plan their finances for buying a property.

When you buy a property, you need to prepare and file many important documents. Each document has its own cost. These steps make sure the property transfer is smooth and legal.

Deed Preparation Fees

Deed preparation is key in real estate deals. Costs for this step are usually around $450. The fees cover:

- Drafting property transfer documents

- Ensuring legal accuracy of deed language

- Verifying property ownership details

Recording Fee Requirements

Recording fees confirm the property ownership change in public records. These fees change by county. They include base charges and costs for each page of documents.

| Fee Type | Cost Range | County |

|---|---|---|

| Documentary Stamps on Deed | 70¢ per $100 of sale price | Statewide |

| Mortgage Documentary Stamps | 35¢ per $100 of loan amount | Miami-Dade |

| Intangible Tax | 0.002 times loan amount | State of Florida |

“Proper documentation is the backbone of a secure real estate transaction.”

Buyers should include these costs in their budget for closing. Working with a skilled real estate attorney can make these steps easier.

Comparing Lawyer Fees Across Florida Regions

Looking at lawyer fees for home closings in Florida shows big differences by region. We’ve dug deep into how these fees vary in different cities and rural areas.

Several things affect how much lawyers charge for closing homes:

- Local real estate market conditions

- Cost of living differences

- Competition among law firms

- Property value ranges

In big cities like Miami, Orlando, and Tampa, lawyers charge more. This is because the market is more complex. But in the Panhandle or small coastal towns, prices are often lower.

“Location plays a critical role in determining legal service costs for real estate transactions.”

Our study found that lawyer fees for closing homes in Florida usually fall between $500 to $1,500. Cities charge more, but smaller places might offer better deals without sacrificing quality.

| Florida Region | Average Legal Fee Range | Market Complexity |

|---|---|---|

| South Florida | $1,200 – $1,500 | High |

| Central Florida | $800 – $1,200 | Medium |

| North Florida | $500 – $900 | Low |

We suggest getting quotes from several lawyers. This way, you can find the best deal for your real estate closing needs.

Cost-Saving Strategies for Legal Fees

Dealing with legal fees for closing a house in Florida can be tough. Homebuyers want to save money without sacrificing quality legal help. Luckily, there are ways to cut down on average closing attorney fees in Florida.

Closing costs in Florida can be up to 5% of the home’s price. It’s key to find ways to save. Our experts will guide you on how to manage legal fees for closing a house in Florida.

Smart Negotiation Techniques

Negotiating legal fees needs a smart plan. Here are some effective strategies:

- Get quotes from different lawyers

- Look for flat-rate fees instead of hourly

- Ask about package discounts

- Talk about fees before agreeing

Service Bundling Options

Bundling services can lower your closing costs. Real estate attorneys in Florida offer packages that save money:

- Bundle title search with legal document review

- Get deals on full closing service packages

- Choose real estate law firms that offer everything

*Pro Tip*: Always get at least three quotes to compare and negotiate better rates.

Using these strategies can help you save on legal costs. You’ll get top-notch legal support without breaking the bank during your home closing.

Legal Requirements for Fee Disclosure

Understanding the legal side of real estate closing fees in Florida is key. Federal laws require clear financial practices to shield homebuyers from surprise costs during transactions.

Lenders and attorneys must give detailed info on closing costs in Florida. They do this through specific legal steps:

- Closing Disclosure document must be provided three business days before closing

- Five-page document detailing final mortgage agreement terms

- Categorization of unchangeable and potentially changeable fees

Here are the specific fee disclosure rules:

| Fee Category | Disclosure Requirement | Maximum Change Permitted |

|---|---|---|

| Origination Fees | Must be precisely stated | No changes allowed |

| Title Insurance | Detailed cost breakdown | Up to 10% increase |

| Recording Fees | Complete transparency | Up to 10% increase |

It’s wise to check all documents for Truth in Lending Act compliance. Borrowers should ask for fee explanations and compare prices to get a good deal.

“Knowledge of legal fee disclosure requirements empowers homebuyers to make informed financial decisions.” – Real Estate Legal Expert

Knowing these rules protects your money during Florida real estate deals.

Additional Closing Cost Considerations

When you buy a home in Florida, you need to know more than just the legal fees. Our guide covers all the costs you might face, from lawyer fees to other expenses.

Buyers should plan for extra costs that can add up quickly. These costs are more than just lawyer fees. You need to budget carefully.

- Inspection fees ranging from $300 to $500

- Property survey costs

- Homeowner association dues

- Prepaid property taxes

- Homeowners insurance premiums

Our research shows that closing costs in Florida average 2.3% of a home’s sale price. For a $409,400 home, that’s about $9,416 in total costs.

| Cost Category | Average Range |

|---|---|

| Loan Origination Fees | 0.5% – 1% of loan amount |

| Appraisal Fees | $300 – $500 |

| Recording Fees | Varies by county |

| Title Insurance | Buyer pays owner’s policy |

“A good attorney may save you costs that exceed their fees by preventing legal pitfalls in the buying process.”

Buyers should budget for these extra costs. Work with your lawyer to understand all the costs of your home purchase. Each property has its own unique costs.

Timing of Legal Fee Payments

Understanding closing lawyer costs in Florida is key. Our guide covers the basics of legal fee payments in real estate deals.

Real estate deals have set payment schedules for lawyer fees in Florida. Lawyers use different payment methods to protect their interests and keep the deal smooth.

Payment Schedule Options

There are several ways to pay for closing lawyer costs in Florida:

- Upfront Retainer: A set amount paid before work starts

- Milestone-based Payments: Fees paid at different stages of the deal

- Closing Day Payment: All fees paid on the day of the property transfer

Escrow Requirements

Legal fee payments often need special escrow setups. Attorneys follow strict rules to handle client money. This ensures everything is done right and fairly.

“Knowing how payments work helps clients plan better and avoid surprises during real estate closings.”

Here are common payment ranges for closing legal services:

- Flat fees between $500 and $2,500

- Hourly rates from $250 to $500

- Comprehensive service packages

Talk about payment terms with your chosen closing attorney. This helps set clear expectations and plans your budget.

Common Legal Fee Structures

Real estate attorneys in Florida often use two main fee structures: flat rates and hourly billing. Flat rates are predictable, with costs ranging from $500 to $1,500 for typical home sales. Legal services for property sales can change based on how complex the sale is and the property’s value.

Hourly billing is another common choice, with rates from $200 to $400 per hour. This method is often used for more complex deals or properties with special legal needs. It’s wise to talk about fees early to know the total cost, which affects your closing expenses.

Some lawyers offer a mix of flat rates and extra charges for special services. For homes worth about $200,000, closing costs can be $6,000 to $12,000. Legal fees are a small but important part of these costs. Knowing about these fee types helps homeowners plan better and choose the right lawyer.

Always ask for a detailed fee breakdown and compare prices with other lawyers. Federal rules require clear fee information, helping you choose the best lawyer for your real estate deal.

FAQ

What are typical lawyer fees for closing on a house in Florida?

Lawyer fees for closing in Florida can range from 0 to 0. This depends on the transaction’s complexity, the property’s value, and the attorney’s experience. Most charge a flat fee or an hourly rate, with an average of 0 for standard home sales.

Do I really need a lawyer for a real estate closing in Florida?

Florida doesn’t require an attorney for closings, but we highly recommend one. A good lawyer can protect your interests, review important documents, and ensure all legal steps are followed. They can also help avoid costly errors.

How do closing costs differ across different regions of Florida?

Closing costs vary across Florida due to local market conditions and cost of living. Cities like Miami or Orlando often have higher fees than smaller towns. Legal fees can change by 10-25% based on the location within the state.

What services are typically included in a real estate closing attorney’s fees?

A closing attorney’s fees cover many services. These include document review, title search, closing meeting representation, and document filing. They also ensure all legal requirements are met, like drafting purchase agreements and reviewing mortgage documents.

Can I negotiate legal fees for a real estate closing in Florida?

Yes, you can negotiate legal fees. It’s wise to get quotes from several attorneys. Discuss different fee structures and possible bundled services. Some attorneys might offer better rates or flexible payment plans, mainly for simple transactions.

What additional costs should I expect beyond the attorney’s basic fee?

Expect extra costs like title insurance, recording fees, and document preparation. These can range from 0 to

FAQ

What are typical lawyer fees for closing on a house in Florida?

Lawyer fees for closing in Florida can range from $350 to $800. This depends on the transaction’s complexity, the property’s value, and the attorney’s experience. Most charge a flat fee or an hourly rate, with an average of $500 for standard home sales.

Do I really need a lawyer for a real estate closing in Florida?

Florida doesn’t require an attorney for closings, but we highly recommend one. A good lawyer can protect your interests, review important documents, and ensure all legal steps are followed. They can also help avoid costly errors.

How do closing costs differ across different regions of Florida?

Closing costs vary across Florida due to local market conditions and cost of living. Cities like Miami or Orlando often have higher fees than smaller towns. Legal fees can change by 10-25% based on the location within the state.

What services are typically included in a real estate closing attorney’s fees?

A closing attorney’s fees cover many services. These include document review, title search, closing meeting representation, and document filing. They also ensure all legal requirements are met, like drafting purchase agreements and reviewing mortgage documents.

Can I negotiate legal fees for a real estate closing in Florida?

Yes, you can negotiate legal fees. It’s wise to get quotes from several attorneys. Discuss different fee structures and possible bundled services. Some attorneys might offer better rates or flexible payment plans, mainly for simple transactions.

What additional costs should I expect beyond the attorney’s basic fee?

Expect extra costs like title insurance, recording fees, and document preparation. These can range from $200 to $1,000, depending on the transaction’s specifics.

How are legal fees typically structured for real estate closings in Florida?

Legal fees in Florida are usually a flat fee or an hourly rate. For standard home sales, flat fees range from $350 to $800. Hourly rates vary from $200 to $350, with costs based on the time spent.

What factors influence the cost of legal fees for a real estate closing?

Several factors affect legal fees. These include the property’s value, transaction complexity, attorney’s experience, location, and required services. More complex transactions, like those with multiple parties or title issues, cost more.

Are there any ways to potentially reduce my closing legal costs?

To lower closing legal costs, get multiple quotes and prepare documents early. Choose a less busy closing period and discuss bundled services. Some lawyers offer discounts for first-time buyers or repeat clients.

How far in advance should I budget for closing legal fees?

Budget for closing legal fees 30-60 days before your closing date. This allows time to research attorneys, get quotes, and ensure you have enough money for fees and other closing expenses.

,000, depending on the transaction’s specifics.

How are legal fees typically structured for real estate closings in Florida?

Legal fees in Florida are usually a flat fee or an hourly rate. For standard home sales, flat fees range from 0 to 0. Hourly rates vary from 0 to 0, with costs based on the time spent.

What factors influence the cost of legal fees for a real estate closing?

Several factors affect legal fees. These include the property’s value, transaction complexity, attorney’s experience, location, and required services. More complex transactions, like those with multiple parties or title issues, cost more.

Are there any ways to potentially reduce my closing legal costs?

To lower closing legal costs, get multiple quotes and prepare documents early. Choose a less busy closing period and discuss bundled services. Some lawyers offer discounts for first-time buyers or repeat clients.

How far in advance should I budget for closing legal fees?

Budget for closing legal fees 30-60 days before your closing date. This allows time to research attorneys, get quotes, and ensure you have enough money for fees and other closing expenses.